Renters and prospective homeowners hoping to stay in San Diego’s Mid-City area may find it more challenging as exploding home values are quickly outpacing incomes.

A draft city report shows that the median value of a home in City Heights, Kensington-Talmadge, Normal Heights and Eastern Area was $723,000 in 2022, the most recent data cited. In 2000, it was nearly $150,000, making for a 384% increase over the two decades.

Meanwhile, the area’s median income during that time grew from $32,000 to $77,000 — a 142% increase.

The numbers tell a familiar story: It’s becoming more expensive to live in San Diego. For Mid-City, in particular, that’s especially true. Its home values have nearly quadrupled — yet the neighborhoods’ incomes remain lower than the citywide median.

As San Diego continues to grapple with a severe housing shortage, experts say the trend will hurt renters — that’s nearly 70% of Mid-City residents — and that part of solving the problem is by adding more housing.

David Ely, an economist and finance professor at San Diego State University, said there are “winners and losers” in this situation.

The winners: homeowners who have lived in San Diego for years, saw their home value appreciate, established wealth — all of which allows them to support the local economy and spend money, he said. The losers: both renters and those interested in buying homes who share the challenge of needing to earn higher incomes.

Ely called that “a net negative.”

“When you think about companies, organizations that need to hire people in San Diego, then you are challenged to attract people to San Diego for those jobs,” Ely said, adding that compensation has to keep up, too.

Valerie Stahl, an SDSU assistant professor for city planning, said whether a Mid-City resident is a winner or loser shouldn’t be “left to luck.”

“I don't think that there should be a boon for some people while other people are really just struggling to pay their rent and think homeownership is out of reach,” Stahl said.

Even with its massive increase over the past couple decades, Mid-City is still below the citywide median home value of $924,000. The city’s draft report does not include statistics on Mid-City’s rent costs.

Stahl said the area’s current circumstances are a recipe for gentrification: Wealthier people could push existing lower-earners out of the neighborhoods.

San Diego cannot solve its housing crisis on its own — or even with current state resources, Stahl said.

“We really need robust federal intervention in this housing problem,” she said. “Housing is increasingly unaffordable, not just in these high demand, high employment regions like San Diego, but also across the state and country.”

There’s no one way to fix a housing crisis, but Stahl and Ely said some action the city could take includes amending zoning laws to allow for more building — construction that city leaders have actively been working on.

They also agree one of the most glaringly clear solutions to help bring down the cost of housing is to create more inventory. San Diego needs an additional 90,000 to 100,000 homes, according to recent estimates.

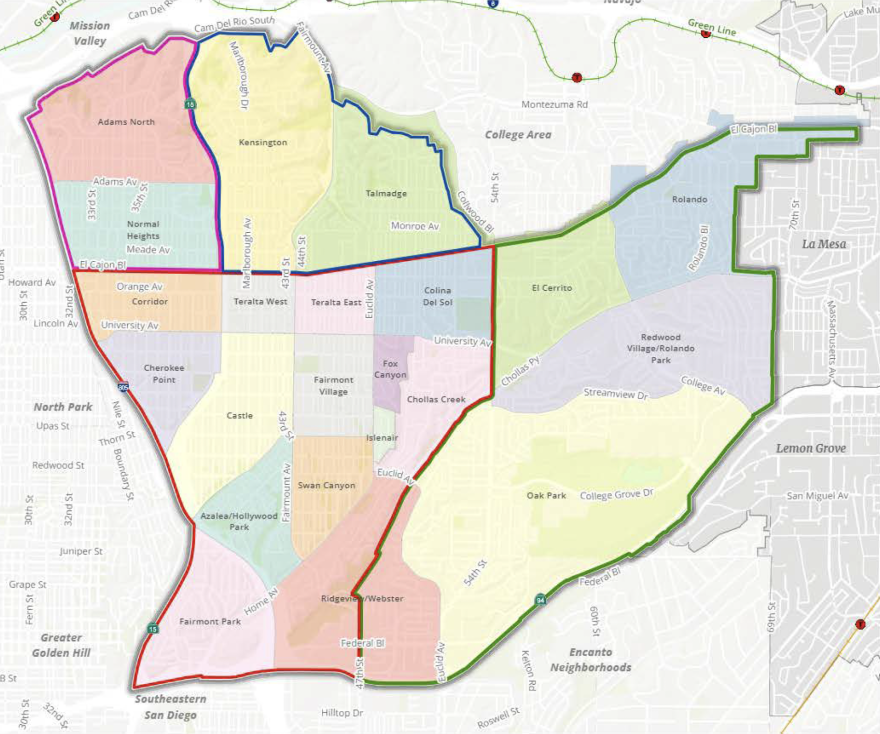

Mid-City, a 13-square-mile region mostly south of Interstate 8 and east of Interstate 805, is made up of 22 neighborhoods within the community planning areas of City Heights, Eastern Area, Kensington-Talmadge and Normal Heights. Part of the indigenous land of the Kumeyaay tribe, the area now is home to a mix of demographics made up mostly by Latinos and enclaves of Asian, Black and white residents.

Between 1980 and 2000, Mid-City saw a rapid growth of roughly 47,000 residents, including an “infusion of immigrant communities,” the report said. But the area only added around 6,000 homes during that time — far from enough to keep up with demand.

Part of the city’s report highlights that previous zoning changes that lowered housing density in the area may have contributed to higher rents and fewer affordable units.

After the city made zoning changes for lower densities in 1998, Mid-City’s population began to drop. Since 2000, it’s declined by 9%, while the city has seen a 14% increase.

Families earning less than $30,000 make up the largest share of Mid-City households, according to the city report, though it varies by neighborhood: The 2022 median household income in the Kensington-Talmadge area was $108,000, and $50,000 in City Heights.

Michelle Alfaro, 29, has lived in City Heights since she was a teenager. She rents a home with her mom and brother for a price that doubled over the past few years.

“I moved out a couple years ago, but it was really hard to keep up alone, so I just came back to help,” Alfaro said. “Then my mom was also struggling keeping up with herself, so it was just beneficial for both of us, honestly, just to help each other out.”

As home values continue to outpace wages, she said she’s saddened to know that in the future, she might not be able to afford buying a home in the neighborhood she knows and likes.

David Moty, 61, owns a home in Talmadge and while he manages to pay a refinanced mortgage, everything else is becoming more expensive, such as phone bills, trash services and groceries, he said.

While he’s seen his home value increase, Moty said unless he leaves Mid-City, “it means nothing to me.”

“Only if you sell it and move somewhere else is the only way to make money,” he said. “And then you throw away all of your friendships and your neighborhood connections and those social resources that you've built up over 10, 20, 30 years that are particularly important when you get older.”

The city report suggests Mid-City’s growth in home value is linked to the housing shortage, but it also pointed to billions of dollars in infrastructure projects, from modernizing school campuses to launching a rapid public transit project and more.

The final version of the city’s report on Mid-City is expected to be completed by the end of the year, and it will inform staff how to update the area’s community plan for the first time in more than two decades.

The revised plan will serve as the area’s 30-year vision for land use, design, mobility, parks, public facilities, open space and meeting climate and housing goals. It is expected to be presented to the City Council in 2026.

This story came in part from notes taken by Hally De Groot, a San Diego Documenter, at an Eastern Area Community Planning Group meeting last month. The Documenters program trains and pays community members to document what happens at public meetings. Read more about the program here.