The wildfires that tore through San Diego County 10 years ago this week destroyed an estimated 1,600 homes. Two couples who lost everything when their homes burned to the ground talk about how the experience changed them.

Bobby Lofton was at home with his wife, Donna, when the Poomacha fire came blazing down the ridge behind his home on the La Jolla Indian Reservation.

“It’s changed my life," he said. “Things are not important anymore, you know, material things. I don’t take life for granted — we could have easily been burned too. I was the last one here.“

Lofton said he tried to wet the house down with the hose, thinking the fire was too far away to reach his home. But Donna Lofton remembers when she had to evacuate.

“When I left, I looked out of the window, it looked like hell,” she recalled. “Everything was on fire and I just started grabbing things and the dogs and got in the car.”

The Loftons had lived in a house below Palomar Mountain for nine years. When they returned, their home was gone, one of nearly 40 homes burned on the reservation.

“It was all gone, there was nothing here,” she said, “Just the ashes. Everything was burnt. There was nothing left.“

They searched through the debris.

“I even went to look in my filing cabinet,” Donna said. “And I thought, ‘Oh, it’s in good shape!’ And I opened it up and everything was black in there, all my papers and everything.”

She fetched three small, white porcelain pieces from another room and laid them on the table.

“There was a little angel left,” she said. “It didn’t burn.”

That and a small plaque with the Serenity Prayer on it, still legible after the fire: “God grant me the serenity to accept the things I cannot change…”

Donna Lofton’s advice:

“If anything should happen,” she said, “be sure to get your pictures and your papers, it’s the most important of all.”

Tribal insurance, AMERIND Risk, rebuilt their home — bigger and better than before. The new house has concrete roof tiles and closed roof vents. Inside, the Loftons have already built up new collections of Native American artwork and colorful blankets. But one of the only mementos of their life before the fire is a large photo on the wall in the corner, saved because they had given this copy to their parents.

“That’s a treasure,” Bobby said. “That’s our wedding, you know.”

“It’s funny,” he said remembering the wildfire. “I still get shook up about it … you think it’s over with, with this new house,” his voice trails off as he looks at his front yard and sees his old home in his mind's eye.

Following the 2007 wildfires, the Intertribal Long Term Recovery Foundation formed to help 15 member tribes in California prepare for disasters and coordinate recovery efforts.

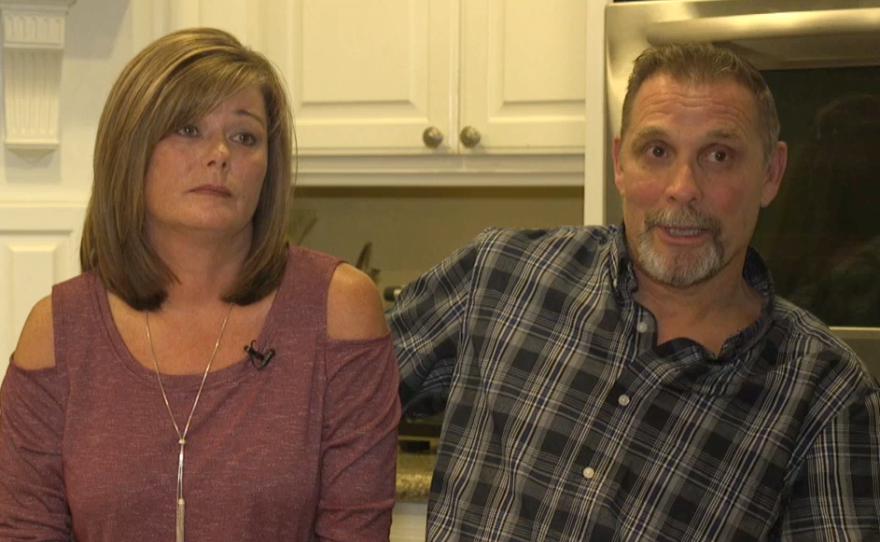

The Caders

Back down the hill, Mary and Buddy Cader live in town, in a subdivision of Rancho Bernardo. But they, too, lost their home and everything in it in the Witch Creek Fire.

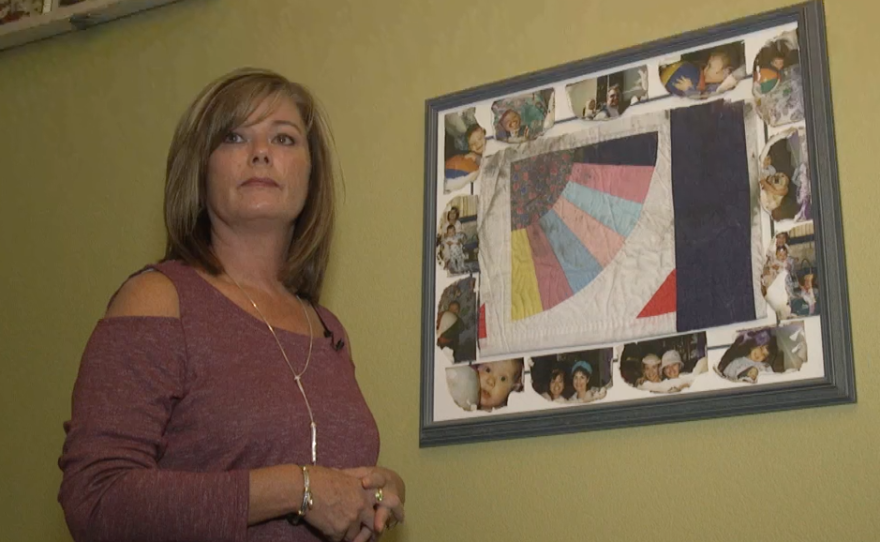

The first thing you see inside the front door of their new home is a large picture frame, full of signed photographs. There is also a fragment of a quilt made by Mary's mother, which was in the washing machine when the fire hit.

“These were all that I could salvage,” Mary Cader said, touching the photos behind the glass. “They all ended up stuck together, you can see where the singed burn is. It’s pictures of my kids when they were little. I lost my baby albums.”

The Caders were awoken by a reverse 911 call and evacuated at 6 a.m. that October night 10 years ago. They expected to be back home in a few hours.

“We’re thinking, ‘Why would we lose a home in the middle of a subdivision?’" Mary Cader remembered, “There’s no way.”

“We’re in two different vehicles,” Buddy Cader recalled. “She had the kids, I had the dogs and I knew we were coming back. I didn’t even think twice. I was like, ‘Why did they wake me up so early?’”

They drove to a friend’s home, where Buddy played pool and Mary watched news of the fire on TV.

“All I remember is Mary screaming at the top of her lungs,” Buddy Cader said, "and I'm like, 'Oh my gosh!'"

“He heard the scream because I knew it was our house,” said Mary Cader, who had seen a picture on the TV screen of a burned-out lot with the telltale shrubs in their yard. “And so the kids came running from downstairs, he came in from inside and at that moment we cried as a family. And that was it.”

She walked upstairs and called their insurance company. From that moment on, she said, rebuilding their life became a full-time job.

“The biggest thing, you know, inventory everything you have,” she said. “From your shoelaces to your Maserati. We tell people just go into one room and go into your junk drawer and then itemize your junk drawer. What did you pay for it? If you have a receipt for it, that’s even better."

For Bobby, the big question is, why did they discover they were underinsured by $50,000, when they had an extended replacement policy for 25 percent of its replacement value?

“That was a shock,” he said. “Well, how much does it cost per square foot to build a house? You don’t know.”

Replacement costs

Bernardo Vasquez, an insurance agent with state farm in San Diego said it’s difficult to estimate the replacement cost of a home because it depends on the home, the area and the labor costs at the time. Vasquez recommended consulting a contractor but said, after a fire, competition for construction services go up.

The estimated replacement cost of a home is not the same as the market value, Vasquez said, because it does not include the value of the land. However, it is included in an appraisal.

How important is listing all your possessions?

“It’s good for you to know what you have before you lose it all, ” Vasquez said. An insurance company will ask you to put together an inventory if you lose your home, but he acknowledged that is difficult to do after the fact. His advice: taking photographs of your home and the possessions in it is often the best way to keep a record.

Vasquez said the most important thing is to talk with an insurance agent about your home every year and go over any changes. However, the agent may not be the person you deal with after a fire. The Caders said they did not see much of their insurance agent after they lost their home. The reimbursements were all handled by an adjuster.

United Policy Holders is a non-profit that helps level the playing field between insurers and insureds. Mary Cader said people who lost their homes in the 2003 wildfires were the most helpful resource in her battle to rebuild.

The Caders said they had to fight the insurance company for what it took to rebuild, an experience that ultimately, Mary Cader said, was empowering.

“The biggest thing we learned was being your own advocate,” she said. “Every gadget that had to be replaced — and doing the property list, and negotiation and talking and insurance meetings and all of that became my life for two years. “

The Caders and the Loftons each rebuilt their homes. But it took years to create a new home.

Mary Lofton said life will never feel as safe as it did before the wildfires of 2007.

“Sometimes, when the weather’s very windy, we get kind of nervous," she said, "and when we come home and see smoke somewhere, we still look and think, ‘Oh dear, I hope that’s not up our way.'”