San Diego-based companies that want to help build President Donald Trump’s border wall are rushing to submit proposals before the deadline next Wednesday.

Finalists selected by U.S. Customs and Border Protection will have to build a 30-foot long prototype in San Diego. Hundreds of companies across the U.S. have expressed interest in bidding.

Shawn Moran, vice president of the National Border Patrol Council, said it’s no surprise the government wants to start the border wall in San Diego, since it's the second-largest Border Patrol sector. San Diego was also the place where the first border fence was erected.

“For a very long time San Diego was really ground zero for the Border Patrol in terms of illegal entries,” Moran said. “And it’s an area that has deep ties with government contractors and also have a large availability of area and diverse terrain where we can test our different strategies or technology.”

The Department of Homeland Security filed two requests for proposals last week, one for a concrete barrier and one for a barrier made of “other” materials permitting visibility of Mexico.

The wall must be between 18 and 30 feet tall and “aesthetically pleasing” on the U.S. side. It must prevent tunneling and climbing and resist a physical breach for at least one hour when exposed to a sledgehammer, a car jack, a pick axe and several other tools. A 10-by-10 foot version of the wall must be built and tested in San Diego, giving local companies an advantage because they know the terrain.

RELATED: San Diego Companies Wait To Bid On Trump’s Border Wall

It’s unclear whether construction on the wall will focus on the 1,300 miles that remain unfenced, or whether officials plan to rebuild the existing 700 miles of fencing – made of steel columns, corrugated steel plates and other materials.

One San Diego-based company that wants to build the wall is R.E. Staite Engineering, located on the San Diego Bay next to the naval base. It has led major construction projects all along the continent’s West Coast and led cleanup efforts after the Exxon Valdez oil spill.

“We’re attracted to very complex, difficult projects in harsh environments – that’s what we do best,” said Ralph Hicks, vice president of governmental affairs.

Hicks said the company sees the wall as an economic opportunity for the region.

“We’re focused on the work. We’re not a political body, left or right or what have you, we go after the job and provide high paying jobs for our workforce and great opportunities for our company,” he said.

Most of the companies that have expressed interest in building the wall, including those led by Mexicans and a Puerto Rico-based company, have told reporters that they are interested for apolitical reasons.

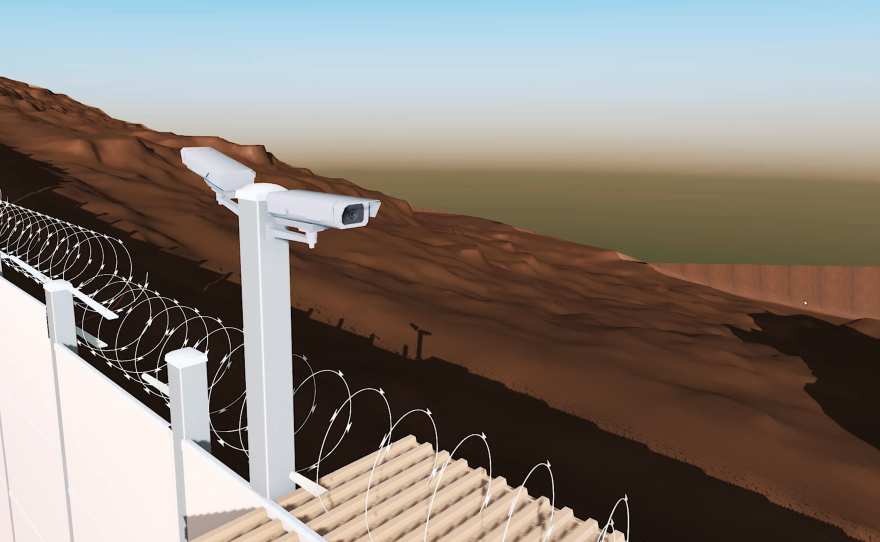

Another San Diego company that wants to get involved is vScenario, which offers building planning services that harness technology and security expertise of former military professionals. Vice president Brian Holley said the company wants to help the government visualize the wall in the early stages, to avoid costly adjustments down the line.

“If the wall goes forward, that's a decision by the president, by Washington, and we as a business and as taxpayers just simply want to make sure the wall is done in a cost-effective, productive way,” Holley said.

vScenario has specialized in security around electrical power grid facilities.

“If we were to be doing sections of this wall, we will continue to hire veterans and I think it’s a great way to bring back those patriots into our society and get them into the business world,” Holley said.

James Gerber, a professor of economics at San Diego State University, said border fence construction in the late 1990s created a lot of jobs, but that they were temporary.

“It’s like building a pyramid in the desert. Yeah, you get some jobs out of that, but the jobs disappear once the construction is finished,” he said.

Some estimates put the border wall construction cost upwards of $20 billion. Trump has claimed that Mexico will reimburse the U.S. for those expenses, but it remains unclear how that would happen. Mexican leaders, including President Enrique Peña Nieto, have vowed repeatedly that Mexico will never pay for the wall.

Gerber said the economic impact on the U.S. could be negative, in part by pushing Mexico further away as a trade partner.

Mexican industry leaders are already drifting towards partners in South America, Europe and Asia, offended by Trump’s border wall and other policies.

“They have been connected so tightly to the U.S. because of its proximity, but the wall is in effect – you can think of this economically – is pushing the U.S. and Mexico farther apart,” Gerber said.

Mexico's largest cement manufacturer, Cemex, initially expressed interest in bidding on the border wall. But after a public outcry the company no longer plans to bid.

Earlier this month, three California Assemblymembers announced legislation that would punish the companies that end up building the wall by requiring the state’s pension funds to divest from them.

“The people of California don’t want to invest in the hateful values that the Trump wall represents,” said Assemblywoman Lorena Gonzalez, a Democrat who represents south San Diego County.

R.E. Staite Engineering declined to comment on the proposed legislation.

Holley of vScenario sent KPBS the following statement: “Shaming U.S. companies out of participating will likely drive the cost of the wall up and shift profits to foreign companies.”