Gov. Jerry Brown and legislative leaders announced a $115.4 billion California budget deal Tuesday that sends billions of dollars more to public schools and universities, boosts spending on social welfare programs that legislative leaders have made a priority and creates the state's first tax credit for the working poor.

The budget deal includes $265 million to add 7,000 state-subsidized preschool slots and 6,800 for child care and extends the state's health insurance program for the poor to children who are in the country illegally, at a cost of $40 million a year.

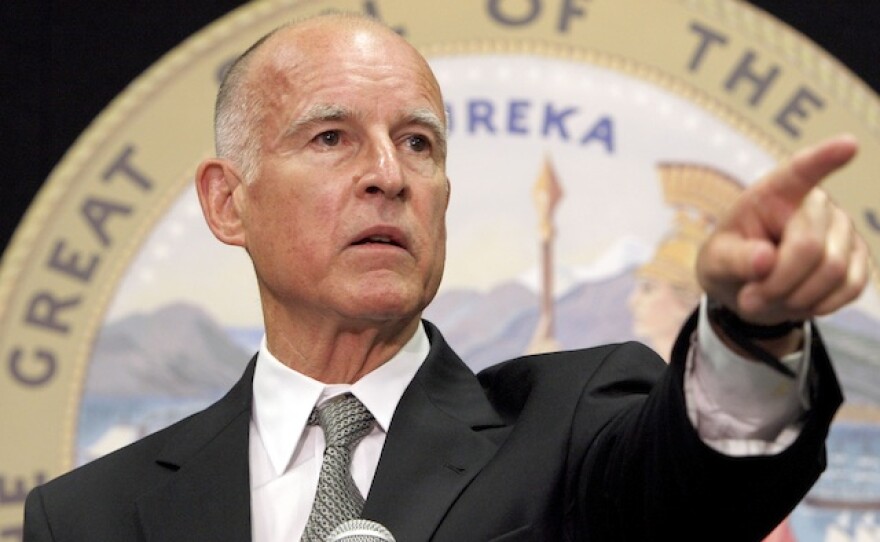

"In the way we come together, we can conclude this is a sound and well thought-out budget. Yet our work never ends," Brown said at a Capitol news conference. "We have to continue to work in a very prudent and careful way. We have to find more resources for our health care and also for our roads and bridges."

The total spending is far closer to Brown's proposal in May for a $115 billion budget than the budget proposed by the Democratically controlled Legislature, which passed a $117.5 billion spending plan a day earlier.

The new deal is expected to easily win approval from the Senate and Assembly, which will schedule votes on the package ahead of the July 1 start of the fiscal year.

Legislative Democrats had sought to restore spending on a host of social welfare programs that were cut during the recession, calling for $749 million in additional spending. But Assembly Speaker Toni Atkins, D-San Diego, and Senate President Pro Tem Kevin de Leon, D-Los Angeles, called the budget deal a win for social services.

"This budget helps reverse the damage done to many working families by cuts made during the great recession," de Leon said.

Still, advocates who had pressured the Democratic governor to expand programs were disappointed. Mary Ignatius, an organizer for child care advocacy group Parents Voices, said Brown missed an opportunity to extend child care to even more needy Californians.

"13,000 more families could have had a chance to either keep their job or get a job that they've been yearning for but haven't had the child care in order to do so," she said.

Brown has cautioned about overspending as the state rebounds from the economic recovery, forecasting that the state could fall short of expected tax revenues. His lower spending figure won praise from Assembly Minority Leader Kristin Olsen, R-Riverbank, who said in a statement that government should budget like Californians do, "based on what we know we will have to spend, not what we hope to earn."

The budget plan includes:

— $14.3 billion in additional funding for kindergarten through 12th grade schools and community colleges.

— $1.9 billion to the state's voter-approved rainy day fund, bringing the balance to $3.5 billion.

— $1 billion to deferred payments owed to schools and $765 million in debt owed to local governments.

— $380 million for a new earned income tax credit to help the working poor.

Brown also announced he is calling two special sessions to address how California funds roads, highways and other infrastructure and Medi-Cal, the state's health insurance program for the poor.

"We have massive underfunding of our road maintenance program, and one way or another, we're going to have to find some solutions," Brown said.

The administration said there is a $5.7 billion annual backlog in road repairs.

"We have to do something, he's right. The question is how we get there," said Assemblywoman Melissa Melendez, R-Lake Elsinore, vice-chairwoman of the Assembly Budget Committee. "There is great hesitancy to vote on any sort of tax measure."